Transactional History

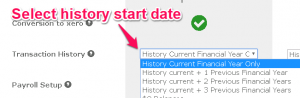

When it comes to your service selection you will be given the choice of a service:

- With transactional history – useful for reporting or referring to past data in Xero, OR

- Limited History service – useful for a fresh start or really messy legacy data.

Current Financial Year: This refers to the financial/fiscal year in which the file is uploaded to Jet Convert and the necessary steps completed (Please understand that the Package Selection and Bank account Mapping need to be completed). Eg. If your file is in calendar year format and uploaded on 1/8/2020 then the 2020 Calendar year will be the "Current Financial/fiscal Year". If it is in a July to June financial year format then "Current Financial year" refers to the 2021 financial year.

Current Financial Year: This refers to the financial/fiscal year in which the file is uploaded to Jet Convert and the necessary steps completed (Please understand that the Package Selection and Bank account Mapping need to be completed). Eg. If your file is in calendar year format and uploaded on 1/8/2020 then the 2020 Calendar year will be the "Current Financial/fiscal Year". If it is in a July to June financial year format then "Current Financial year" refers to the 2021 financial year. Prior Financial Year: This refers to the year prior to the Current Financial/fiscal Year defined above.

Prior Financial Year: This refers to the year prior to the Current Financial/fiscal Year defined above. If you would like a conversion without transactional data please see this link.

If you would like a conversion without transactional data please see this link. Transactional History

Most times we can convert at least current plus the previous financial year of history. The maximum amount of transactional history that we can convert under a package is the Accelerate package where current plus 3 previous financial years is converted. Should you require additional years please see our custom conversions.

The amount of history you receive may be reduced if:

- the desktop software file has been rolled into the current financial year

- it has multiple locations

- It is Account Edge

- there are errors or a large number of transactions in the file

How Much History?

You will see on the conversion service selection page how much history you can receive under the basic Xero sponsored service and any options to purchase additional history.

You choose the amount of history, and you receive all transactions from the last day data was entered into the file until the transactional history option selected .

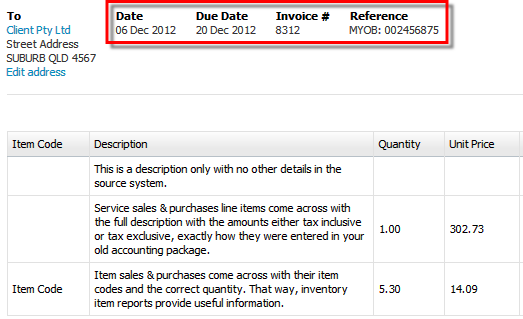

Invoices

All open invoices and bills will be converted unless they are prior to 2013.

Invoices convert with full line item details and all payments against them.

A full and accurate history within Xero means there is no need to go back to the source file to look anything up. All invoices, statements and Credit Notes can be created and emailed from within Xero exactly as they were in your old software.

Invoice and customer reference numbers will be converted into separate fields in Xero for invoices. With bills there is only one field available in Xero so the supplier invoice number and the purchase order number will be concatenated, with the invoice number appearing in brackets {} after the purchase order number.

Every single invoice-line is transferred, including lines with description only. Item invoices use the correct item codes and quantities. Any original invoice that is entered including tax, will arrive in Xero in the same way.

Item codes come across on approved Invoices and bills. You will NOT receive item codes on credit notes, draft invoices or bills.

During the conversion, we cannot allocate ‘Billable expenses’ against Clients in Xero. As a result, this information needs to be updated post-conversion.

Note with invoice numbers, due to the data mapping process you will lose any zeroes at the start of the invoice number e.g. invoice number 0001285 will appear as 1285 in Xero.

If invoices have been paid with general journals in the source file we will be unable to allocate these to the invoices in Xero as Xero does not allow manual journals to system accounts (Accounts Receivable, Accounts Payable or Bank Accounts). Instead we will allocate these journals to an Originals account and the payments can be manually applied to the invoices or bills post conversion.

Recurring Invoices, bills, scheduled payments and recurring manual journals do not come across as part of the conversion. You will need to enter these in Xero following conversion.

With purchase invoices and bills, we will convert both the bill or invoice number AND the client reference number/order number into the Xero invoice number. If you do not wish to see both you will need to edit the invoices in Xero post-conversion.

Note:

- Xero has a quantity limit of 4 decimal places, should your source file have more than 4 decimal places we will replace the quantity with 1 and include the correct quantity in the memo field.

- Limit of 10 characters on invoice numbers.

Notes for MYOB files:

With MYOB conversions you also receive invoice due date. ABNs will be converted for contacts.

Our software can only import sales services orders/quotes, not items sales orders/quotes.

For MYOB conversions Quotes & Orders in the items sales format will not be converted.

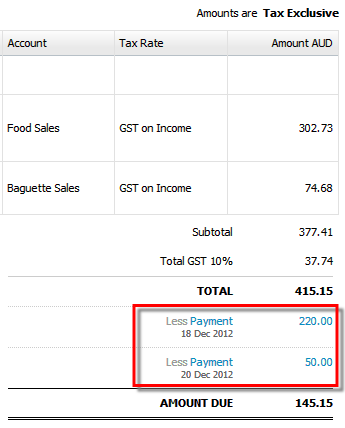

Payments and Credit Notes

Every payment is transferred and booked against each invoice.

That means you can see exactly when payments were made against all invoices when clients need to talk to debtors.

This also includes Credit Notes that are assigned to another invoice to pay it off. Full details (as in invoices) with one additional line representing any assignment to another invoice or refund.

Each Credit Note is accurately assigned to the invoice/bill on the day that it is assigned in the source file.

Any overpayments are handled accurately through Credit Notes. So when you enter the next invoice for a client who has paid a deposit, a credit note will automatically remind you of it.

Bank Transactions

Reconciled according to the source file.

All bank transaction details are transferred with reconciliation exactly matching what is already reconciled in the source data as long as they have been coded to a Chart of Account. Any transactions that are uncoded will not convert.

So in this example, starting the bank feeds from 1 November will pick up the unpresented cheques from before and

automatically pre-match them during the normal bank reconciliation process.

This means that all the work done is preserved in Xero and the client can continue where they finished off in the old accounting system.

Comparing Bank Reconciliation Reports

The Bank reconciliation reports may not match between the source data and Xero if:

- Reconciliation has occurred in the source file after the publication date of the Bank Reconciliation report

- Reconciliation has occurred in the Xero organisation following conversion.

If you want to compare reconciliation reports between the source data and Xero we recommend that you:

- Reconcile to a certain date in the source data and then publish as of that date before sending the file to us.

- Cease all work in the source data file once you have run that report.

- Publish the same Bank Reconciliation report in Xero before starting to reconcile any transactions in Xero.

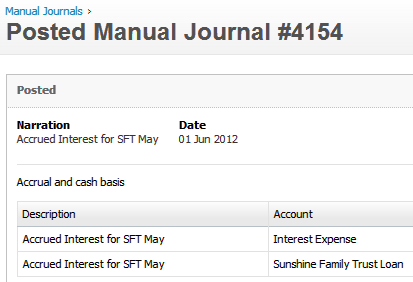

Manual Journals

Exactly as the accountant intended.

All manual journals (general journal) details come across exactly as they are entered in the source file with the correct accounts and GST settings.

Xero does not allow bank accounts to be used in Manual Journals and Invoices, so they are replaced by a “Transfer Account” and an additional Spend Money or Receive Money transaction is created.

Xero also does not allow any journal entries to Trade Creditors and Debtors to keep the integrity of the data intact. Any Invoices or Bills that have been paid off via manual journals in the source file will need to be reviewed post-conversion in Xero. You may need to apply payments against open Invoices/Bills if they had previously been paid in your source file. The balance in the Account Receivable/Payable Original account can be used to offset the open Invoices/Bills imported post-conversion in Xero. If there has been excessive use of journals against the system account in the source file we may not be able to complete the conversion with transactional history.

To bring some of the information from the source file to Xero we may need to use clearing accounts during the conversion. Each transaction in the conversion clearing account has a Debit amount and corresponding Credit amount. These accounts enable us to reproduce the data from your old accounting package as accurately as possible. At the end of the conversion these accounts will balance $0 and be archived.

Related Articles

Bank Reconciliation Post Conversion

How to deal with the reconciliation post-conversion can vary depending on how up-to-date the accounting data file was when it was uploaded for conversion. In addition, whether you ordered a history versus balances service will influence when you need ...MYOB (AU & NZ)

MYOB Preparation Checklist It is ESSENTIAL you work through the information detailed on this page before starting your conversion. This preparation needs to be completed in the file access that you are providing. This will ensure that you will have a ...Bank Feeds

Bank Account Mapping - Bank Account / Credit Card / Paypal / Asset / Liability Any account you want to reconcile in Xero, or receive bank feeds for need to be selected as a bank, credit card or PayPal. Each bank requires the accounts to be set up in ...Limited Transaction Options

If you are starting afresh or have really messy data then a transaction free or limited transactions service is for you. You get to choose which service you want on the service selection page. $0 Balances This conversion gives you all the business ...$0 balance invoices/Differences in the GST Reconciliation Report

Invoices that have positive and negative lines that result in the balance of the invoice being $0.00 are captured differently among accounting systems. These are sometimes used to Journal an amount from one account to another without creating a ...